- Equipment Financing

Finance the Equipment You Need Without Tapping Your Cash Flow

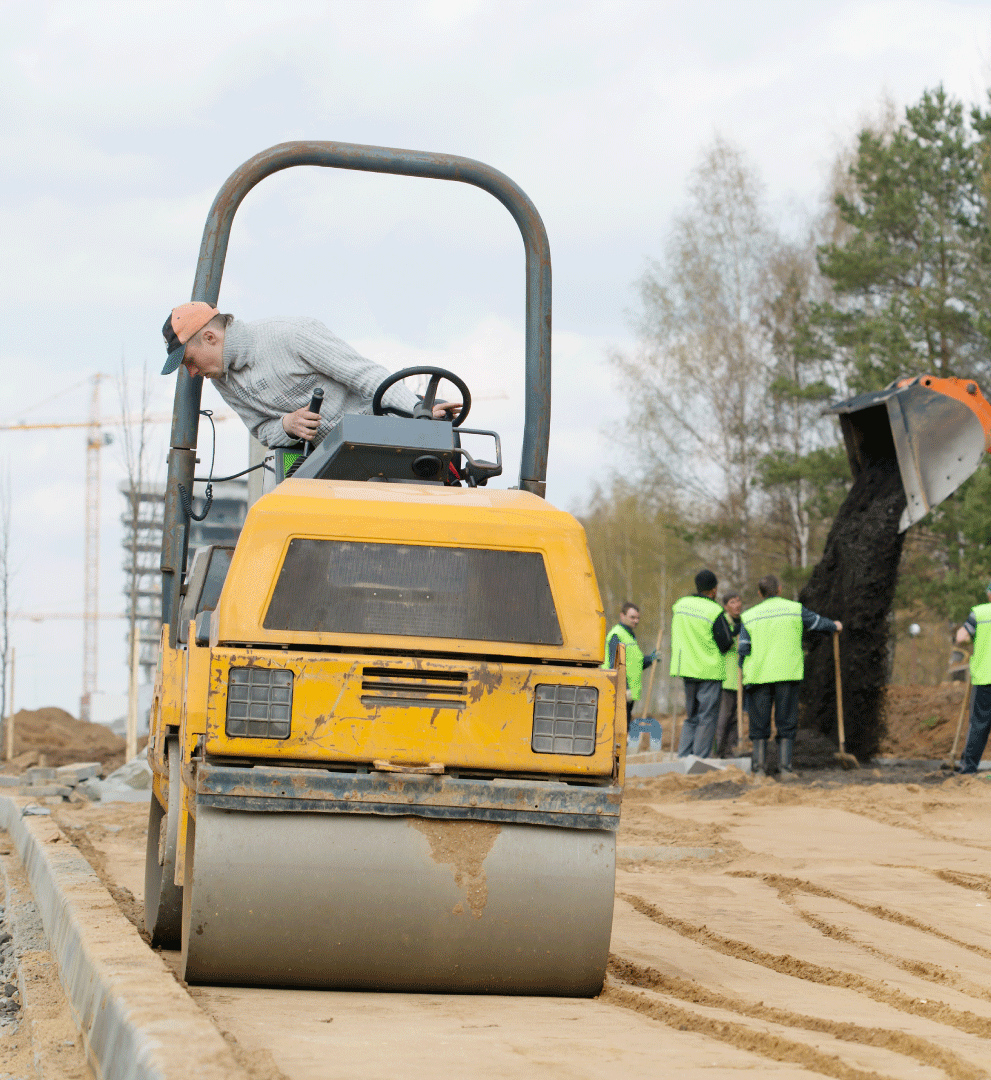

Need to upgrade or replace equipment but don’t want to drain your working capital? Equipment financing lets you purchase essential tools, machinery, or vehicles without the upfront cost. Whether you’re investing in medical devices, commercial kitchen gear, tractors, trailers, dump trucks, heavy machinery, or even office tech, we’ll help you get it done quickly and affordably.

Program Snapshot

Amount

$10K – $10M

Term Length

Up to 10 years

Loan to value

Up to 100%

Credit Pull

Soft (no impact on credit score)

Closing Time Frame

Within a week and as fast as 48 hours

Repayment

Monthly

Why Choose Equipment Financing?

Keep Your Cash Flow Intact

Finance 100% of the equipment cost, including soft costs like delivery, installation, and setup.

Same-Day Approvals Available

Move fast when opportunity strikes.

Deferred Payment Options

Start now, pay later. Flexible repayment terms available to qualified borrowers.

All Types of Equipment Covered

From titled vehicles to niche industry tools, we cover 90% of equipment types across most sectors.

Build Business Credit

Every on-time payment strengthens your profile for future funding.

What Kind of Equipment Can Be Financed?

If it helps your business operate, chances are we can finance it. Common examples include:

- Medical equipment

- Construction and heavy machinery

- Commercial vehicles or trucks

- Restaurant ovens, refrigeration, or POS systems

- Office furniture, printers, computers

- Farming, logging, and landscaping equipment

- Manufacturing tools, lasers, saws, and more

What You’ll Need to Apply

- Basic credit application

- Invoice, bill of sale, or equipment quote

- 6 months of business bank statements

- Financial statements and tax returns (for $300K+ requests)

- Voided business check or bank letter

FAQs

What is equipment financing?

What types of equipment can I finance?

Do I need perfect credit to qualify?

How much can I borrow for equipment?

What is the repayment term for equipment financing?

Is a down payment required?

Can I finance used equipment?

How fast can I get approved?

Does equipment financing have any tax benefits?

What Do You Qualify For?

Every business is different — and so are your options. We’ll help you figure out what programs fit your goals and guide you through the process step-by-step.

Minimum Requirements:

- Business must operate in the U.S.

- Business bank account required (for most programs)

- No open bankruptcies

- No lender defaults within the last 12 months

Let’s Get You Funded

Our friendly team would love to hear from you.